Saving is much easier if you never see the money in the first place, which is what setting up direct deposit into a savings account can do for you. For example, you might reward yourself for meeting your savings goals by devoting a portion to that cruise you've always wanted to take. Saving money is not all drudgery you can also save for fun, short-term goals. Likewise, when it's time for a new car, using your savings for a substantial down payment will drastically reduce the amount of interest you'll end up paying on your car loan. If becoming a homeowner is a dream of yours, it will be hard to come up with the requisite down payment of 10-20 percent without saving consistently. When unexpected expenses strike, savings prevent you from having to rack up costly payday loans or credit card debt just to make ends meet. If you're not sold on the importance of savings, consider the following benefits: Unless saving is your number-one priority and the first "bill" you pay each month, it's unlikely that you will ever find room in your budget for it. Step 2: Pay Yourself First Make Saving a Priority Although these programs are sometimes expensive, they offer features like financial goal-tracking, visual graphs of your spending, and bank account and investment management. Financial software, like Quicken and Microsoft Money, can do even more for you than spreadsheets.

#Household budget worksheet dave ramsey password

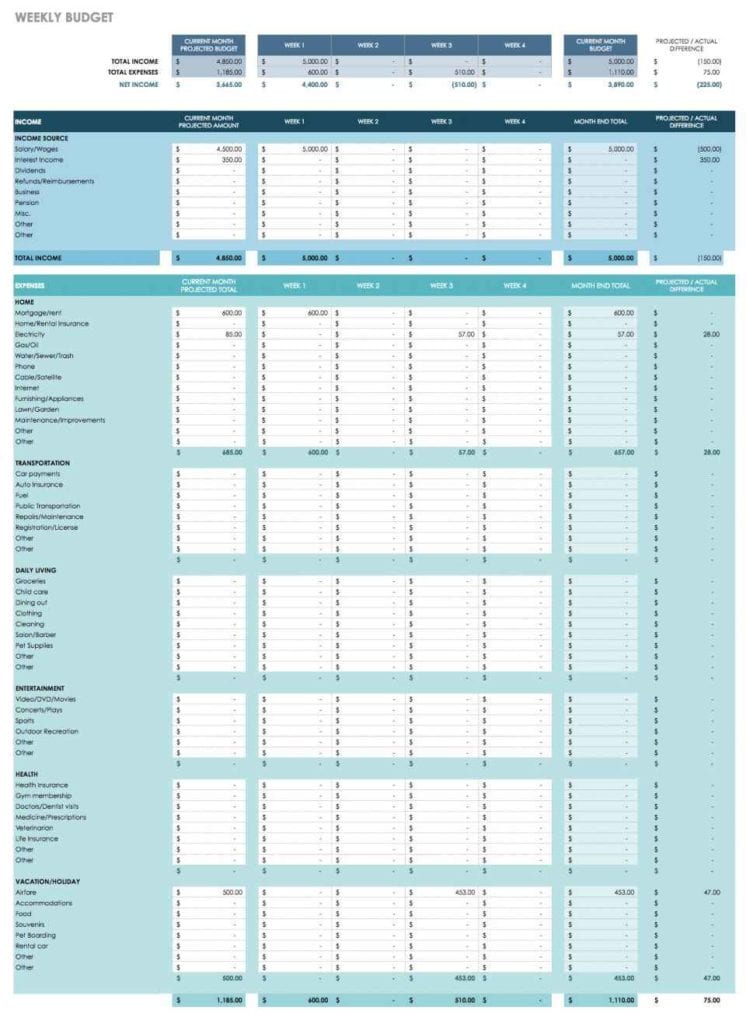

This method is safer than the pen-and-paper method since you can password protect the file and don't have to worry about misplacing it. You can easily total your expenditures and deduct them from your checking account balance to show what you have left. You'll still need receipts to track your spending with spreadsheets, but the benefit of programs like Excel is that they do the math for you. You might want to categorize each expense, as well (e.g., food, transportation, housing, entertainment, etc.).

Write down every purchase you make and bill you pay, and add up your expenses at the end of each day. Unless you want to be the person obsessively jotting numbers down in a notebook at every cash register, you'll need to save receipts to track your spending the old-fashioned way - paper and pen. Here are several ways you can record your expenses: While you can track your spending manually, technology can make the task much less onerous. For 30 days, record every penny you spend, from vending machine purchases to credit card interest to rent. You set yourself up for failure by setting goals uninformed by reality, so track first and set goals second. One of the most common budgeting pitfalls is setting overly ascetic spending limits only to abandon the budget completely after a short time. To set realistic budgetary goals, you first need to know how and how much you're spending. Step 1: Find out Where Your Money Goes Track Spending for One Month In the following guide, we will walk you through seven simple steps that will help you develop and follow a budget that will move you toward your financial goals.

Realistic goals and the right tools and strategies will help you stick with the budget you create. As with a weight-loss program, consistency is key to budgeting successfully.

#Household budget worksheet dave ramsey how to

A sound, sustainable budget can fast-track your financial goals, whether that means paying off a credit card, saving for a new car, or planning for a comfortable retirement.īudgeting is a lot like dieting in that most people know exactly how to create a plan it's executing that plan that is the real challenge. While the word "budget" may make you cringe, it is the single best tool to break the nerve-wracking cycle of living paycheck to paycheck. Have you ever looked at your bank account balance and wondered where all your hard-earned money goes? If so, it's probably a safe bet that you don't budget.

0 kommentar(er)

0 kommentar(er)